- FOKION AVGERINOS – DR. IKE: Athletic Director, Youth Mentor, and Healer

- American Hellenic Institute’s Golden Jubilee Celebration

- Leadership 100 Concludes 33rd Annual Conference in Naples, Florida

- Louie Psihoyos latest doc-series shocks the medical community The Oscar–winning director talks to NEO

- Meet Sam Vartholomeos: Greek-American actor

George Petrocheilos Spins Catalio Capital Management into Biotech Breakthroughs

At just 28 years old, George Petrocheilos is already running a private equity firm with over 250M assets under management. With offices in Baltimore and Washington, DC, and now in New York, Catalio Capital Management LP is ready for the next phase of its rapid growth.

John Catsimatidis Jr. and George Petrocheilos

Co-Founder and Managing Partner George Petrocheilos hails from Athens, Greece, and came to the US in 2009 to study at Johns Hopkins University, where he received his degree in Financial Economics. There he served as President of the Johns Hopkins Hellenic Association, where he was active in promoting Hellenism. While he was at Hopkins, George became close with leading Greek-Americans in Baltimore like Aris Melissaratos, a leading executive at Westinghouse Corporation and the late John Paterakis, Sr., the founder of H&S Bakery, Inc. whose mentorship and guidance played an influential role in his professional development. Fresh out of college, George made it to The Baltimore Business Journal’s “40 under 40” list of winners at just the age of 22.

President-Elect Joe Biden and George

It’s no wonder then that he would continue to rise the ranks to eventually form Catalio Capital Management, as Co-Founder and Managing Partner, along with Dr. R. Jacob Vogelstein who holds a Ph.D in Biomedical Engineering from the Johns Hopkins School of Medicine. Prior to Catalio, both George and Jacob were General Partners at Camden Partners Holdings, LLC, a private equity firm that spun out of T. Rowe Price (NASDAQ: TROW), where they launched its life sciences division.

“It is incredibly rewarding to be able to directly partner with the world’s most successful scientist-entrepreneurs to translate their basic research into commercial ventures that enhance the lives of millions of patients around the globe. We truly believe that investment in the life sciences and biotechnology sectors has never been more critical and we continue to see an incredible opportunity for growth in these businesses.”

With science pumping through their veins and a vested interest in life sciences, they joined forces and started their own company devoted to biomedical technology investments that will lead the next wave of breakthrough drugs, devices and diagnostics. The company was launched in 2020 and was conceived with the Greek word for catalyst, Catalio, in mind. A unique aspect of the fund is their inclusion of an elite group of world-class scientists with primary academic appointment in the General Partnership. They are also serial entrepreneurs; each having founded a couple of biotech companies.

George Petrocheilos, George Tsunis, John P. Angelos

Catalio’s move to New York is the next logical step for the firm. Since its inception, Catalio has invested in 250 high growth life sciences companies, and raised over 250 million dollars. This rapid growth prompted the next big move. George knows that there is a lot of talent in New York, and he wants to reach that talent with his firm. New York might be going through a rough patch now, with the Covid 19 pandemic, but that is all the more reason for George to continue his mission. Finance, science, and New York seem to be the perfect life science match.

George with U.S. Senator Chris Van Hollen

George wants to make an impact on human lives globally. Having been exposed to all the depth of technology and science happening at Johns Hopkins, he became intrigued by the idea of financing biomedical technology growth: “Science is making an impact on our lives everyday through new breakthroughs that are needed to improve human lives.” He wants to help make the quality of life better for as many people as possible by investing in the best breakthrough biomedical technology companies that will bring their drugs, devices, and diagnostics to millions of patients around the world.

Christos & Kiki Petrocheilos, George Petrocheilos, Jayne Plank, Aris Melissaratos

Catalio invests in companies at all stages of development, from company formation to IPO. Investments include liquid biopsy companies Thrive Earlier Detection (that got acquired by EXACT Sciences in October for over 2 billion dollars) and Freenome, drug discovery company Recursion Pharma, mental health-start up COMPASS Pathways (NASDAQ: CMOS), which went public in September and monoclonal antibody treatment firm AbCelllera (NASDAQ: ABCL), that went public earlier this month.

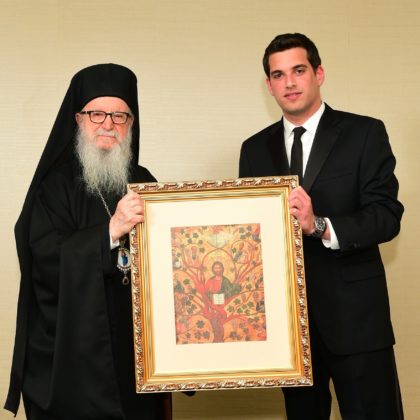

Archbishop Demetrios and George Petrocheilos upon being inducted into the Leadership 100

Key Members of the leadership team include its Chairman Edward J. Mathias, who played a key role in the founding of The Carlyle Group (NASDAQ: CG) and a member of its Board of Directors up until his 2019; along with General Partners and investment Committee Members Tom V. Brooks and Dr. Kenan Turnacioglu. Prior to joining Catalio, Tom served as an executive for Goldman Sachs (NYSE: GS) and later as Vice Chairman & Executive Vice President for Constellation Energy (NYSE: CEG). Dr. Turnacioglu co-founded long short equity hedge fund PointState Capital, LP in 2011, from which he retired in 2018. Prior to that, he was a Managing Director and Head of Healthcare Investments at Duquesne Capital, the investment firm of renowned investor Stan Druckenmiller.

Dr. Freda Lewis Hall, recently retired Chief Medical officer and Executive Vice President of Pfizer (NYSE: PFE) also came on board Catalio earlier this month as their newest Venture Partner.

Catalio Capital Management Co-Founders Dr. Jacob Vogelstein and George Petrocheilos

George and Dr. Vogelstein remarked that “It is incredibly rewarding to be able to directly partner with the world’s most successful scientist-entrepreneurs to translate their basic research into commercial ventures that enhance the lives of millions of patients around the globe. We truly believe that investment in the life sciences and biotechnology sectors has never been more critical and we continue to see an incredible opportunity for growth in these businesses.”

John Catsimatidis Jr., Ted Leonsis, George Petrocheilos, Zach Leonsis

When asked about innovation in Greece, George is very optimistic, and emphasized the phenomenal work of Prime Minister Kyriakos Mitsotakis and his administration. In his own efforts, George is a member of the board of the Hellenic Innovation Network at MIT’s Enterprise Forum, whose goal is to help connect Greek start-ups in the US. His interest in Hellenic issues is one that also comes with strong civic minded awareness. He is a member of the Hellenic American Leadership Council (HALC), led by Endy Zemenides, whose mission is a commitment to the ideals of democracy, rule of law, and philanthropy. He was very grateful to the late Nikos Mouyiaris, the co-founder of HALC and a prominent Greek-Cypriot businessman and philanthropist, for his friendship and mentorship on many issues affecting Greece and Cyprus by emphasizing advocacy and public policy.

George with Baltimore Police Commissioner Kevin Davis, Roula Paterakis and the late John Paterakis, Sr.

George also serves on the Board of the Trustees for the Kennedy Krieger Institute, a Johns Hopkins Medicine affiliate, that focuses on improving the lives of children with neurological disorders and developmental disabilities.

Anthony Liveris, George Petrocheilos, John Catsimatidis Jr., Diamantis Xylas

His commitment personally and professionally to improving quality of life for patients worldwide, through investing in breakthrough biomedical technology companies, is the science of the future. At just 28 years old, with the recent successful fund close, he’s way ahead, racing through the catalyst stage.

0 comments