By Peter Shakalis

Numerous properties are being offered for sale indicating a strong total transactional volume for all of 2011. These figures include freehold transactions and recapitalizations where partial ownership interests exchange hands.

Prices for all types of properties have rebounded. In the second quarter, the average price of a Manhattan office property was $544/sf, up from $457/sf in the second quarter of 2011. The market bottomed out in 2009 when the average price was $333/sf.

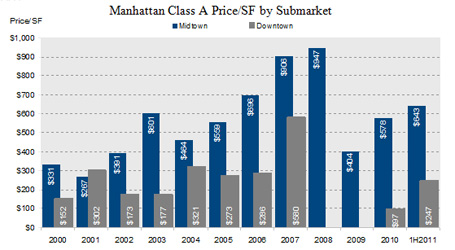

The average Class A sales price for the first half of 2011 was $615/sf. This is almost double the $325 psf Class A average in the first half of 2010, although that number was skewed by a large Class A sale Downtown. When comparing just Midtown Class A sales the average in the first half of 2011 was $643/sf, a 41% increase over the $474/sf Class A average in the first half of 2010.

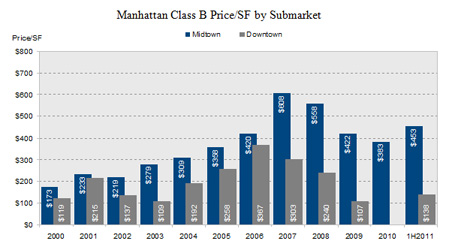

The average Class B sales price for the first half of 2011 was $364/sf. This is an 11% decrease from the $411/sf Class B average in the first half of 2010. When Downtown buildings are excluded, the average for the first half of 2011 rises to $453/sf a 10% increase over the average in the first half of 2010, when no Downtown buildings traded.

A multitude of investors have been active in the market including SL Green, the largest owner in Manhattan, which has acted as both a buyer and a seller this year. Fosterlane Management, the sovereign Kuwaiti investment authority, acquired the largest single asset, 750 Seventh Avenue, from Hines Interests in a $485 million trade. The largest recapitalization involved 1633 Broadway where Paramount, a firm with German origins, acquired an interest held by investment banks Morgan Stanley and Merrill Lynch.

Investment sales activity has been largely fueled by the expectation that the rental market has bottomed and that rents will continue to increase. For the first half of 2011, approximately 15 million square feet has been leased in Manhattan. Rents have increased from $50.18 in the first quarter of 2011 to $51.59/sf in the second quarter of 2011. In addition, debt capital is available at interest rates which have remained at or near historic lows. These factors have kept capitalization rates down, which has resulted in per square foot pricing that is only 30% below the levels seen during the market peak in 2007.

Capitalization rates for core Manhattan office buildings are 5.0% to 5.5%, nearly as low as they were in the market peak in 2007. The difference today is that recent sales have had a substantially higher equity component, comprising approximately 30% to 40% of the purchase price. In the heady days of high leverage, equity capital was only 10% to 20% of the purchase price.

There has not been a flood of distress in New York City office buildings. While a handful of physically and financially distressed assets sold over the past two years, the majority of owners and lenders have been rewarded by restructuring debt and holding on to the properties when possible while waiting for the market to recover.

The Manhattan real estate market is cyclical, with peaks and valleys in both rents and values. Employment and the subsequent demand for office space drive the market; there is little new construction to flood the market with new inventory. Assuming that employment continues to rise modestly, the Manhattan real estate market should continue to appreciate in the near term.

(James Murphy, Managing Director of investment Sales at Colliers International contributed to this article. James.murphy@colliers.com)

Peter Shakalis is a Director at Colliers International NY LLC